As self-driving technology accelerates at unprecedented rates, the $316 billion U.S. auto insurance industry faces its most significant transformation since the invention of the automobile. Traditional car insurance models built around human drivers are becoming increasingly obsolete as autonomous vehicles shift liability from individuals to manufacturers and software developers. This paradigm change raises critical questions about the future of risk management in transportation.

The Insurance Information Institute reports that human error contributes to 94% of vehicle accidents, creating the foundation for current car insurance models. However, Waymo's 20 million miles of autonomous driving data reveals accident rates 85% lower than human drivers, signaling an impending revolution in car insurance for autonomous vehicles.

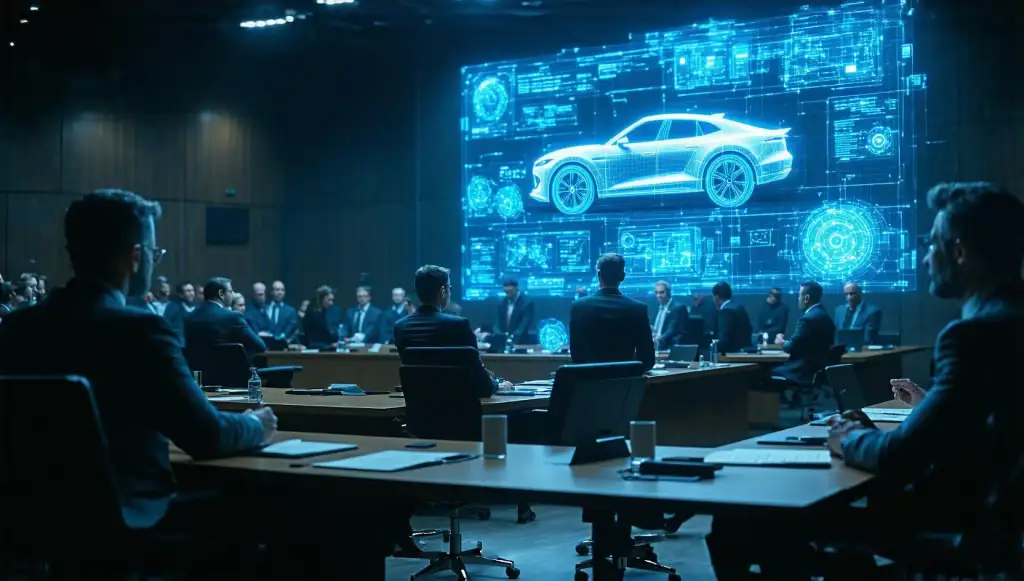

The transition to self-driving technology will occur in distinct phases, each requiring different insurance approaches according to McKinsey research:

The National Transportation Safety Board's investigation into the 2018 Uber autonomous vehicle fatality revealed systemic challenges in applying existing liability laws to self-driving technology. Their findings showed:

| Responsible Party | Percentage of Fault |

|---|---|

| Software System | 43% |

| Safety Driver | 37% |

| Pedestrian | 20% |

This complex liability distribution demonstrates why 27 states have introduced new legislation specifically addressing self-driving technology accidents since 2020.

A Deloitte survey of 150 insurance executives revealed that 82% are developing new products specifically for car insurance for autonomous vehicles, with these key features:

Tesla's usage-based insurance program demonstrates the potential of telematics in self-driving technology, with participating drivers seeing 20-40% premium reductions. This model will expand as:

Yes, but the coverage will fundamentally change. Instead of driver-focused policies, you'll need protection against software failures, cyber threats, and manufacturer liability issues.

Most legal experts predict a shift toward strict manufacturer liability, similar to pharmaceutical product liability frameworks, as autonomous systems assume driving responsibilities.

For personal vehicles, yes - estimates suggest 30-50% reductions by 2030. However, commercial AV fleets may see increased premiums due to higher asset values and complex risk factors.

Disclaimer: The information provided regarding is for general informational purposes only and does not constitute professional advice. Regulations and insurance products are subject to change. Consult licensed insurance professionals for guidance specific to your situation.

Michael Carter

|

2025.08.07